5.7 Billion Won Transaction of a 10-Story Building Laying 'Golden Eggs' at Sillim Station! 1.64 Billion Won Jackpot in 4 Years on Nambusunhwan-ro Main Road

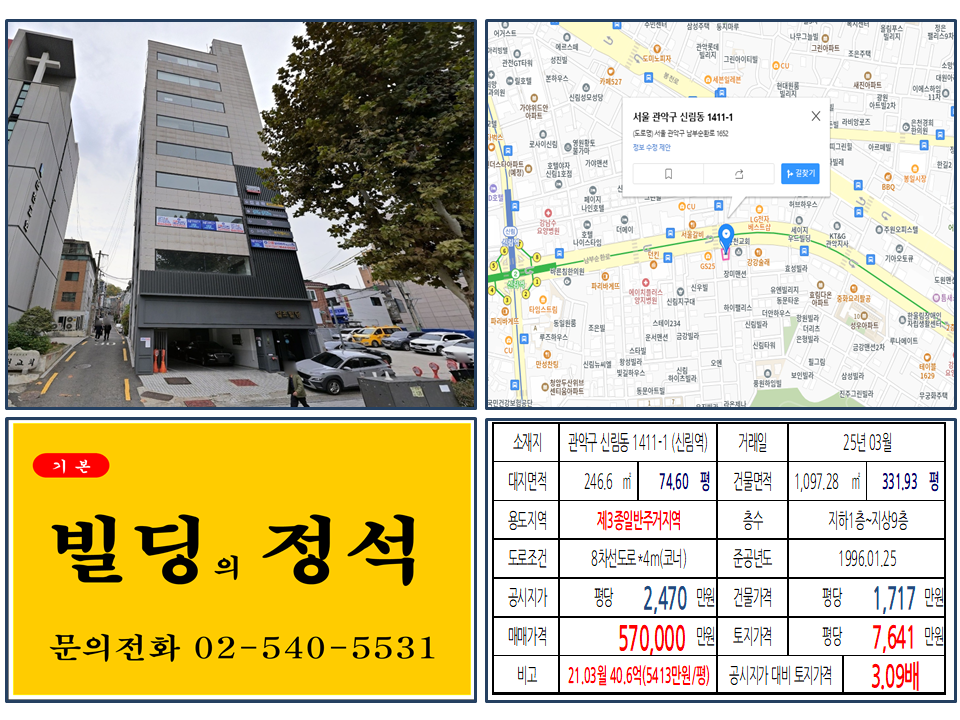

A 10-story building located in the Sillim Station area, a key commercial district in southwestern Seoul, in Sillim-dong, Gwanak-gu, Gyeonggi-do, has been traded for ₩5.7 billion, emerging as a hot topic in the real estate investment market. This building, situated on the 8-lane Nambusunhwan-ro main road and boasting excellent location conditions as a corner building facing a 4m road, recorded a surprising rate of return by realizing a capital gain of over ₩1.6 billion in just 4 years. In particular, the analysis suggests that securing a floor area ratio comparable to a quasi-residential zone despite being in a Type 3 General Residential Zone further increased its investment value.

In this article, we will analyze the detailed transaction history of the 10-story building in Sillim-dong, Gwanak-gu, and delve deeply into the locational advantages of the Sillim Station area, the background behind its high rate of return, and the impact of the floor area ratio benefit on its investment value. Furthermore, we will honestly examine the value of the building as a roadside corner property, along with its limitations, aiming to provide useful insights for those interested in investing in income-generating real estate in downtown Seoul.

₩5.7 Billion 10-Story Building in Sillim-dong, Gwanak-gu, Detailed Transaction Analysis

The building that was recently sold is located at 1411-1 Sillim-dong, Gwanak-gu, and is situated in a prime location very close to Sillim Station on the Seoul Subway. It was traded for ₩5.7 billion in March 2025, and the land price was assessed at ₩7.641 billion.

- Location: 1411-1 Sillim-dong, Gwanak-gu

- Subway Station: Sillim Station

- Transaction Date: March 2025

- Sale Price: ₩5.7 billion

- Land Price per Pyeong: ₩76.41 million

- Land Area: 74.60 pyeong (246.6㎡)

- Building Area: 331.93 pyeong (1097.28㎡)

- Zoning: Type 3 General Residential Zone

- Floors: Basement 1st Floor ~ Ground 9th Floor

- Road Condition: 8-lane road * 4m corner

- Completion Year: January 25, 1996

- Publicly Assessed Value: Approx. ₩24.7 million

- Publicly Assessed Value Ratio to Land Price: Approx. 3.09 times

Held for 4 Years, The Secret to the ₩1.64 Billion 'Jackpot' Rate of Return?

The most surprising aspect of this building is the high rate of return recorded in a short period. This building, which was sold for ₩4.06 billion in March 2021, was resold for ₩5.7 billion in just 4 years, generating a capital gain of ₩1.64 billion. This is an enormous rate of return, amounting to approximately ₩410 million per year, or approximately ₩34.17 million per month. The analysis suggests that this high short-term profit was possible due to the excellent location conditions of the Sillim Station area, along with the competitiveness of the building itself.

Floor Area Ratio of a Quasi-Residential Zone in a Type 3 General Residential Zone? A 'Hidden Benefit'

Particularly noteworthy is the fact that this building secured a floor area ratio comparable to a quasi-residential zone despite being located in a Type 3 General Residential Zone. Generally, in a Type 3 General Residential Zone, construction is possible up to a floor area ratio of 250%, but this building was able to be built up to 10 stories by securing a floor area ratio exceeding this. This floor area ratio benefit acted as a factor that significantly increased the building's value and appears to have played a decisive role in maximizing the investment return.

Roadside 10-Story Building, Securing High Accessibility and Visibility

This building, located on the 8-lane Nambusunhwan-ro main road and boasting a 10-story scale, secures excellent accessibility and visibility. It is easily noticeable not only to the large floating population using Sillim Station but also to drivers passing by on the main road, making it an optimal location for commercial facilities. This is advantageous for attracting rental demand from various types of businesses and can lead to stable rental income.

Small Exclusive Area is a Regrettable 'Limitation'

While this building boasts a high rate of return and excellent location conditions, the small exclusive area is pointed out as a somewhat regrettable limitation. The land area is relatively small at 74.60 pyeong, so the exclusive area on each floor may not be large compared to the total building area. This may be somewhat disadvantageous for large franchises or businesses that require spacious areas. However, with the excellent location conditions of the Sillim Station area, it is expected to sufficiently absorb the demand from various types of businesses, such as small-scale commercial facilities or offices.

Conclusion: 10-Story Building in Sillim Station Area, An Attractive Investment Property with High Profitability and Development Potential

This 10-story building located in the prime Sillim Station area of Sillim-dong, Gwanak-gu, is an attractive investment property that has achieved a high rate of return in a short period based on its excellent location conditions and floor area ratio benefit. Its value as a roadside corner building and the abundant floating population allow for expectations of stable rental income, and future value appreciation is also expected along with the development of the Sillim Station area commercial district. Although it has the limitation of a small exclusive area, the best location in the Sillim Station area will more than offset these drawbacks. If you are considering high-yield real estate investment in a key commercial district in downtown Seoul, paying attention to this building in the Sillim Station area could be a wise choice.

The building at 1411-1 Sillim-dong, Gwanak-gu, was sold in March 2025.

※ Transaction Details

- Location: 1411-1 Sillim-dong, Gwanak-gu

- Subway Station: Sillim Station

- Transaction Date: March 2025

- Sale Price: ₩5.7 billion

- Land Price per Pyeong: ₩76.41 million

- Land Area: 74.60 pyeong (246.6㎡)

- Building Area: 331.93 pyeong (1097.28㎡)

- Zoning: Type 3 General Residential Zone

- Floors: Basement 1st Floor ~ Ground 9th Floor

- Road Condition: 8-lane road * 4m corner

- Completion Year: January 25, 1996

- Publicly Assessed Value: Approx. ₩24.7 million

- Publicly Assessed Value Ratio to Land Price: Approx. 3.09 times

※ Past Transaction Details

- 1. March 2021: Sold for ₩4.06 billion (₩54.13 million per pyeong)

- 2. March 2025: Sold for ₩5.7 billion (₩76.41 million per pyeong) (Held for approx. 4 years)

- 3. Gain from sale of ₩1.64 billion over 4 years,

- Annual gain from sale of ₩410 million,

- Monthly gain of ₩34.17 million

- (Only analyzes simple gain from sale)

※ 상기 내용은 국토교통부 실거래신고 및 당사 거래확인 사실을 참고한 사항입니다. 부동산 투자를 위한 참고용으로 가격변동 및 신고내용변경이 있을 수 있음을 참고해주세요.

※ 위의 글과 관련하여 문의가 있으시거나 궁금한 사항이 있으시면 아래 전화번호와 채팅방으로 문의주세요!!!

※ 연락 주시고 내방해 주시면 다양한 부동산 정보를 안내해드리고 #건물매입 대한 도움을 드리고 있습니다.

※ #꼬마빌딩 매입 계획이 있으시다면 연락을 주시고 내방 미팅 신청 부탁드립니다.

※ 매각사례를 통해 주변 시세와 발전방향에 대해 항상 모니터링 하고 있습니다.

※ 다양한 경험과 신뢰를 바탕으로 건물주가 되는 그날까지 함께 고민하겠습니다.

※ 데이터를 기반으로 한 프로그램 분석을 통한 확실하고 안정적인 #부동산 구입 분석 제공하고 있습니다.

※ 매입부터 매각까지 원스톱 #빌딩 매니지먼트를 제공하며 다양한 사례 분석을 통해 고객만족도를 높이고 있습니다.

※ 서울 및 수도권 전역의 다수 매물을 확보하고 있고, 인근 매매 거래 사례 분석 및 정확한 #상권분석 통한 최적의 물건을 찾아 맞춤 상담을 해드리겠습니다.

※ 시장조사, 입지선정, 상권분석, 예산계획, 법적검토, 수익성분성, 위험관리, 개발계획 및 회수 계획까지 다양한 관점으로 부동산 구입을 위한 결정을 함께 고민해 드리겠습니다.

※성공적인 건물주가 되기 위한 첫걸음에 함께 연구하고 함께 하겠습니다.